Nowadays managing wealth involves more than just safeguarding assets. It’s about also creating an inheritance. Families around the world are looking beyond financial advice. They’re searching for structure, flexibility, and a reliable partner who knows the intricacies of their lives. They’re increasingly getting answers from Dubai’s DIFC.

With its top-quality regulatory environment and innovative legal frameworks, the Dubai International Financial Centre (DIFC) has become a magnet for entrepreneurs, families from around the world and business owners who are ready to take wealth planning to the next level. And at the heart of it all are four powerful tools: the DIFC Foundation, Dubai Family Office, DIFC Prescribed Company, and Private Trust Companies.

Let’s explore why these solutions aren’t simply financial structures, but are part of a much bigger story.

The DIFC Foundation: Planning with the goal

It’s comforting knowing that your wishes are honored after your passing. The DIFC Foundation has a modern flexible structure that allows families to plan their wealth, pass it on and safeguard it.

DIFC Foundations provide a higher amount of flexibility and control than trusts that are traditional. A DIFC Foundation is a blueprint that you can use to protect your assets, transfer shares of your family business, support charitable causes or defend the assets from risk that is not anticipated.

The best part? It’s a quiet worker that gives you strong legal protection, privacy, and peace-of-mind for the generations to come.

The Dubai Family Office is built around people, not portfolios

Every family is different. Many have multi-generational companies. Certain are handling international assets as well as making preparations for their next generation to assume leading roles. The new Dubai Family Office is more focused on personalization than one-size solution that fits all.

In Dubai, and especially in the DIFC Family Offices are evolving into holistic platforms that go beyond the realm of investment management. Family offices are the heart of everything that is important to your family, from tax planning to governance and succession strategies to education and the education of your heirs.

It’s not just dealing with money. It’s about managing relationships, meaning and accountability.

DIFC Company Prescribed: Silently Effective

There aren’t any wealth structures that have to be complicated or loud. Sometimes simple is the way to go. The DIFC Prescribed Company is a flexible and effective tool that can hold assets, structure deals, or design special-purpose vehicles.

These entities are especially useful for entrepreneurs, families, and investors who want to take advantage of DIFC’s ecosystem, but without the burden of heavy regulation. Imagine them as silent engines that facilitate global transactions while providing privacy, ease-of-use as well as compliance to international standards.

The use of prescribed companies in conjunction with foundations and trusts can be a powerful device to assist families build wealth.

Private Trust Companies: Trust but with Control

Families with delicate issues or complex needs could have a difficult time transferring control of their affairs to an uninvolved trustee. Private Trust Companies (PTCs), however, offer a compelling option.

PTCs permit families to establish their own corporate trustees. This allows the trustees to place important decisions in the hands trustworthy individuals. They’re typically close family members or advisors. This kind of structure is well-liked by families that are entrepreneurial or people with multiple jurisdictions who are seeking greater involvement, but without sacrificing integrity and fiduciary standards.

When established within DIFC’s supportive legal framework, the PTC becomes an effective tool to maintain control and compliance.

Prioritizing People – The Human Side to Wealth Planning

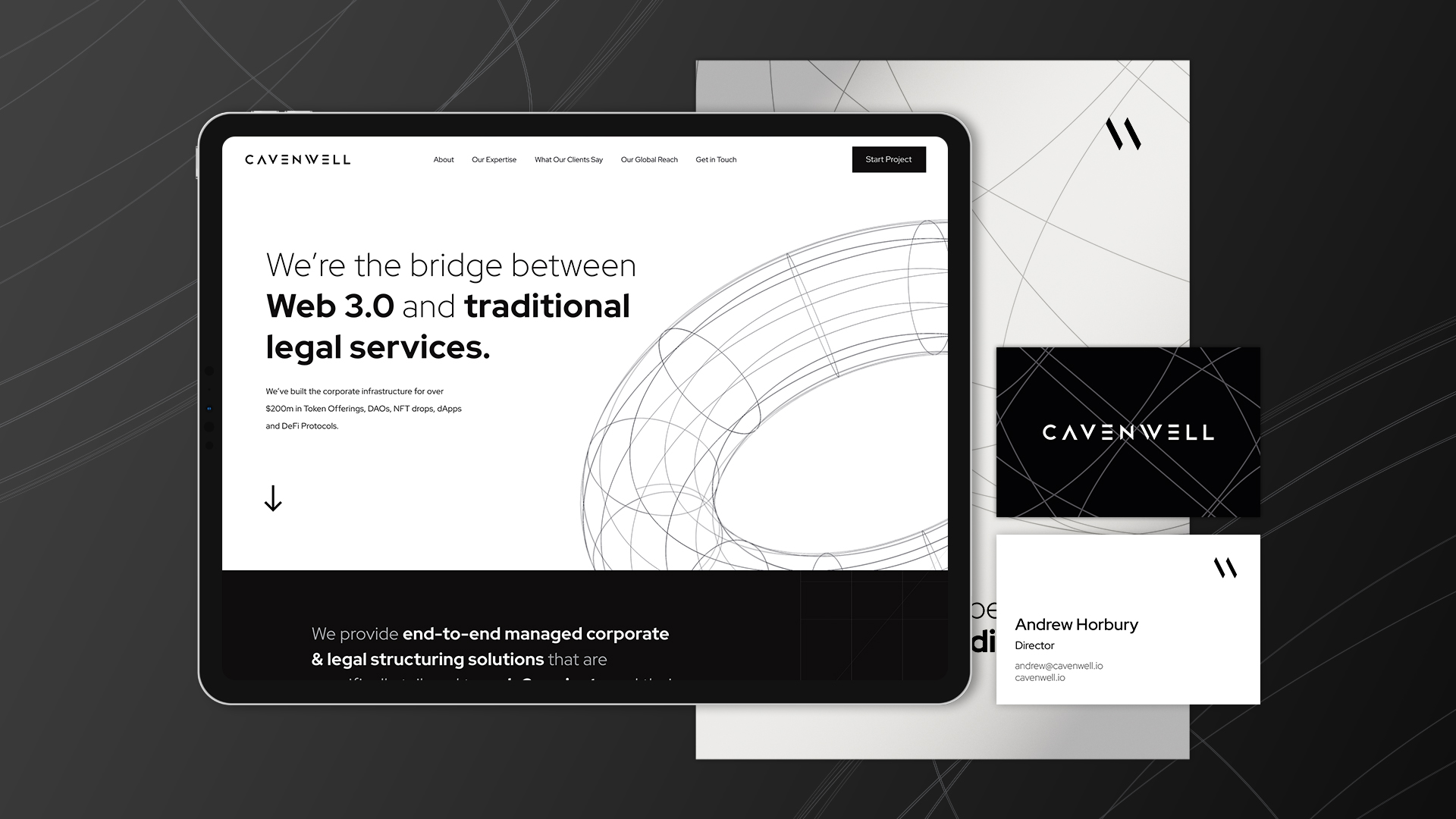

In a world of technology, automation, and companies that are based on automation, it is refreshing to find firms that lead by example with empathy and personal touches. The Companies Cavenwell blend technology with a deep human insights to deliver wealth solutions that are intelligent personalized, customized, and tied to the individual’s journey.

Wealth is not just about numbers and forms but also the people who comprise it. It is crucial that the structures you build reflect the values you hold dear. It doesn’t matter if you use a DIFC Foundation or a Dubai Family Office. It’s the same with it could be a DIFC Prescribed Company.